Invoice coding plays a crucial role in Accounts Payable (AP) by ensuring expenses are properly tracked and recorded. It helps businesses manage budgets, maintain clean records, and stay compliant when done right. But doing this manually can be time-consuming and prone to mistakes. This is where automation tools like Serina can help simplify the process and reduce errors.

In this guide, we’ll explore invoice coding, why it’s essential, the challenges with traditional methods, and how Serina can streamline the entire process.

What is Invoice Coding in Accounts Payable (AP)?

Invoice coding involves assigning specific accounting codes, like General Ledger (GL) codes, cost centers, and project codes, to each invoice. These codes make sure that all expenses are categorized correctly in the company’s financial system.

Key Elements of Invoice Coding:

- GL Account Codes: Identifying the type of expense, like office supplies, utilities, or travel costs.

- Cost Center Codes: Pinpointing the department responsible for the expense, such as sales, marketing, or HR.

- Project Codes: Tying expenses to specific projects for accurate tracking.

- Expense Categories: Grouping expenses into broader categories like operating costs, capital expenses, or research and development.

- Tax Information: Tracking expenses that are taxable or tax-exempt to meet compliance requirements.

- Vendor Information: Linking vendor details to the codes for clear and consistent record-keeping.

Example: If the marketing team buys office supplies, you might assign a GL code for office supplies, a cost center for marketing, and a project code if it’s part of a specific campaign.

Why Do You Code Invoices?

Accurate invoice coding is crucial for efficient financial management. Here’s why:

- Tracking Expenses: This helps monitor where your money is going, making budgeting and tracking easier.

- Maintaining Accurate Records: Keeps financial statements clear and accurate, reducing the risk of mistakes.

- Facilitating Audits: Properly coded invoices provide a clear trail for auditors, making audits simpler.

- Ensuring Compliance: Correct coding aligns expenses with regulatory requirements and prevents financial misreporting.

- Managing Budgets: Helps compare actual spending against budgets for each department, enabling better budget control.

- Project Tracking: Assigning codes helps track costs tied to specific projects to keep them on budget.

Common Challenges in Manual Invoice Coding

Manual invoice coding can be tricky and challenging, especially as businesses grow. Here are the common issues AP teams face:

- Human Errors: Manually coding hundreds or thousands of invoices can lead to mistakes in financial records.

- Time-Consuming: Manually reviewing and coding invoices takes up valuable time and slows down the AP process.

- Inconsistent Coding: Different employees might apply codes differently, leading to confusion and mistakes in financial statements.

- Scaling Issues: As your business grows, the number of invoices increases, and managing these manually becomes overwhelming.

- Matching Invoices and POs: Manually matching invoices to purchase orders (POs) is slow and prone to errors.

- Delayed Payments: Manual processes can cause delays in approving and paying invoices, leading to strained vendor relationships.

Traditional Methods of Invoice Coding

Traditional invoice coding involves a lot of manual work by AP staff. They review each invoice, assign codes, and then enter these into the accounting system. While this method works for smaller companies, it quickly becomes inefficient as businesses grow.

Typical Steps in Manual Coding:

- Reviewing Each Invoice: AP staff manually review invoices for details like vendor, amount, and date.

- Assigning Codes: Staff members choose the correct GL codes, cost center codes, and project codes.

- Manual Data Entry: They enter the coded information into the company’s accounting software.

- Cross-Checking for Errors: A second review is often necessary to catch any mistakes.

- Approval Routing: Invoices are manually routed to approvers via emails or physical documents.

- Delayed Approvals: The manual process often results in delays, leading to late payments.

Drawbacks of Manual Methods:

- Error-Prone: Manual data entry and coding can result in incorrect information and misclassified expenses.

- Time-Consuming: Coding each invoice manually takes a lot of time, especially when dealing with large volumes.

- Slow Payments: Delays in coding and approvals can hurt vendor relationships.

How Does Invoice Coding Work?

The process of coding an invoice involves a few key steps:

- Assigning GL Account Codes: Identify the type of expense, like rent, office supplies, or travel.

- Allocating Cost Center Codes: Determine which department is responsible for the expense.

- Adding Project Codes: If applicable, assign codes that tie the expense to specific projects.

- Recording Vendor Details: Make sure to record the vendor’s information and the transaction date.

- Categorizing Taxes: Ensure that taxes are categorized correctly based on the nature of the expense.

Double-Checking for Accuracy: Verify that all information and codes are applied correctly.

How Serina Streamlines Invoice Coding

Serina automates the entire process of invoice coding, making it faster and reducing the chance of errors. Here’s how it helps:

- Automated GL Coding: Serina applies GL codes automatically using predefined rules, ensuring consistency.

- Handling Non-PO Invoices: For invoices without purchase orders, Serina uses vendor data and machine learning to automate the coding.

- PO Matching: When invoices are tied to a purchase order, Serina automatically matches them, ensuring the correct codes are applied.

- Consistent Coding: Serina’s automation follows the same rules every time, preventing inconsistency.

- High-Volume Processing: As your business grows, Serina can handle increasing volumes without adding more workload.

- Reducing Errors: Automation cuts down on human mistakes, improving the accuracy of your financial records.

The Problems with Scaling Manual GL Coding

As businesses grow, manual coding becomes a bigger issue. Here are the main challenges:

- More Errors: Higher volumes of invoices lead to more opportunities for mistakes.

- Time Constraints: It becomes impossible for AP teams to keep up with increasing invoice volumes manually.

- Inconsistent Coding: Different employees applying codes differently can lead to confusion.

- Labor Costs: Manual coding requires more staff to handle the growing workload.

- Approval Delays: Invoices can pile up and slow down the entire process.

- Vendor Issues: Late payments caused by slow processing can damage relationships with key vendors.

Overcoming Challenges with Serina

Here’s how Serina addresses these problems:

- Consistent Coding: Serina applies rules consistently to all invoices, preventing confusion and mistakes.

- Fewer Errors: By automating repetitive tasks, Serina cuts down on human errors.

- Scalable Solutions: Serina can handle high invoice volumes without adding to your team’s workload.

- Quicker Approvals: Serina routes invoices to the right people automatically, reducing delays.

- Cost Efficiency: Automation reduces the need for additional staff, saving on labor costs.

- Stronger Vendor Relationships: Faster payments help maintain positive relationships with vendors.

How Serina’s Automated Invoice Processing Works

Here’s an overview of how Serina streamlines the entire AP workflow:

- Invoice Capture: Serina captures invoices from various sources, like email, EDI, or scanned documents.

- Data Extraction: It pulls key details like vendor information, amounts, and dates from the invoices.

- PO Matching: If an invoice is tied to a purchase order, Serina automatically matches it to the corresponding PO.

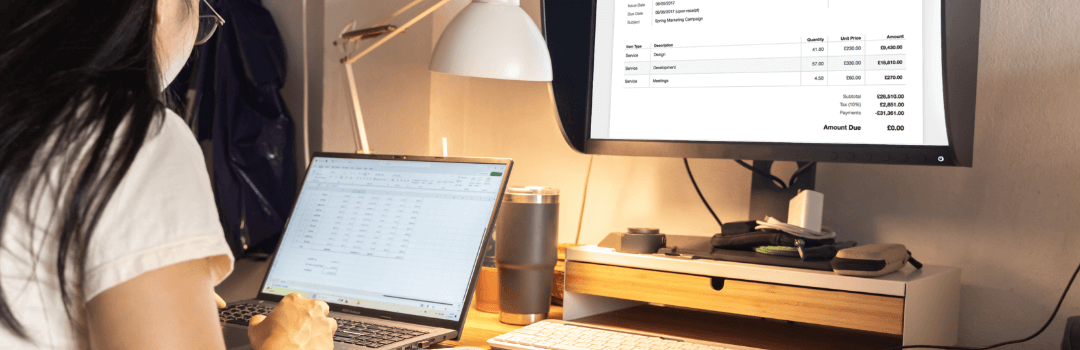

- GL Coding and Mapping: Using pre-set rules, Serina assigns GL codes, cost centers, and project codes.

- Approval Workflow Automation: Serina automatically routes invoices to the right people based on predefined rules.

- Payment Processing: Once invoices are approved, Serina can initiate payments through your ERP or banking system.

- Audit Trails and Compliance: Every action taken on an invoice is tracked by Serina, ensuring compliance and transparency.

- Integration with ERP Systems: Serina integrates with major ERP systems, allowing for easy data transfer without manual re-entry.

Conclusion: Simplify Invoice Coding with Serina

Managing invoice coding manually can slow down your AP workflow and lead to costly mistakes. Serina automates the entire process, saving time, improving accuracy, and ensuring compliance. Whether you’re handling PO or non-PO invoices, Serina’s automation solutions help you scale efficiently and reduce operational costs.

Ready to optimize your AP process? Let Serina help you automate invoice coding and payments, so your team can focus on what matters most—growing your business.