The terms and conditions of an invoice are an essential part of any business deal. These provisions provide clarity and legal conformity in financial transactions in addition to safeguarding the interests of the buyer and seller.

The significance of vendor and supplier invoice terms and conditions, what to include, samples, templates, and the different clauses required for a professional invoice will all be covered in this article.

Importance of Invoice Terms and Conditions

Invoice terms and conditions serve as a legally binding agreement between the service provider or seller and the buyer. Here are some key reasons why they are essential:

1. Clarity in Transactions

Clearly defined terms and conditions eliminate confusion and misunderstandings between parties regarding payment timelines, methods, and responsibilities.

2. Legal Protection

In the event of a dispute, the terms and conditions act as a legal reference to resolve conflicts. They protect your business from potential liabilities and non-payment issues.

3. Encourage Timely Payments

Stipulating payment deadlines and late payment penalties incentivizes customers to pay on time, improving cash flow for your business.

4. Builds Trust and Professionalism

Comprehensive and transparent invoice terms demonstrate your business’s professionalism and help build trust with clients.

5. Compliance with Tax Regulations

Including specific tax-related clauses ensures compliance with local tax laws, safeguarding your business from potential legal complications.

What Should Be Included in Invoice Terms and Conditions?

When crafting invoice terms and conditions, it’s essential to include specific details that cover all aspects of the transaction. Here’s what to include:

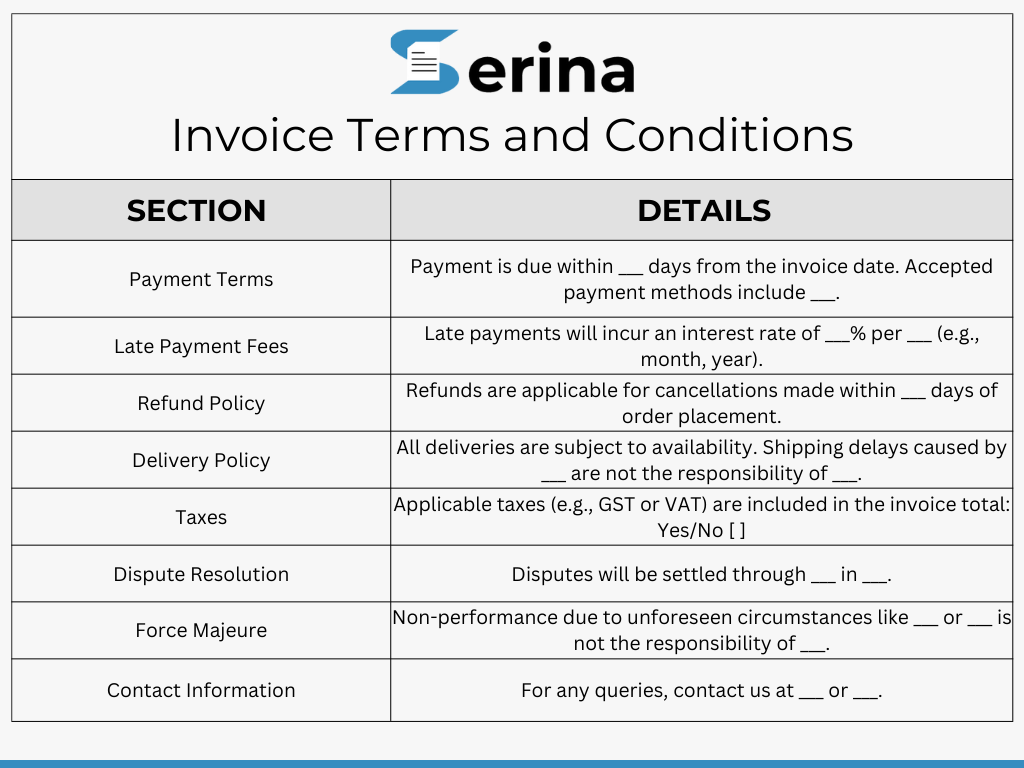

1. Payment Terms

- Due Date: State the deadline for payment (e.g., “Payment is due within 30 days of the invoice date”).

- Payment Methods: Specify accepted payment methods such as bank transfer, credit card, PayPal, or cash.

2. Late Payment Fees

Outline penalties for late payments, such as interest rates or fixed charges. For example, “A late payment fee of 1.5% per month will be charged for overdue invoices.”

3. Cancellation and Refund Policies

Detail the conditions under which refunds or cancellations are accepted, along with associated fees.

4. Delivery and Shipping Details

If applicable, include shipping timelines, responsibilities, and liabilities for delayed or damaged goods.

5. Tax Details

Include applicable taxes like VAT, GST, or sales tax. Mention the tax identification number if required.

6. Dispute Resolution

Specify how disputes will be handled, including mediation, arbitration, or court jurisdiction.

7. Confidentiality Clause

Protect sensitive information shared between parties by adding a confidentiality agreement.

8. Force Majeure Clause

Account for unexpected events like natural disasters, strikes, or pandemics that may impact service delivery or payments.

9. Contact Information

Provide clear contact details for queries or payment-related concerns.

Invoice Terms and Conditions Examples

Here are some practical examples of invoice terms and conditions for various scenarios:

General Terms and Conditions

- Payment is due within 15 days of the invoice date.

- Late payments will incur a penalty of 2% per month.

- Goods remain the property of [Your Business Name] until full payment is received.

Service-Based Business

- Payments are non-refundable once the service is delivered.

- Any cancellations must be made at least 48 hours before the scheduled service date.

- Disputes must be reported within 7 days of receiving the invoice.

E-Commerce Business

- All shipping fees are non-refundable.

- Returns will be accepted within 14 days of delivery, provided the item is unused and in original packaging.

- [Your Company] is not liable for delays caused by shipping carriers.

Invoice Terms and Conditions Template

Here’s a ready-to-use template for your invoice terms and conditions:

Clauses in Terms and Conditions

Invoice clauses are specific statements or provisions that provide clarity and legal security. Here are some commonly used clauses:

Payment Clause

“This invoice must be paid within 30 days of issuance. Failure to pay may result in additional late fees.”

Ownership Clause

“Ownership of goods remains with the seller until full payment is made.”

Jurisdiction Clause

“All disputes related to this invoice will be resolved under the jurisdiction of [City, State].”

Cancellation Clause

“A cancellation fee of 20% of the total invoice value will apply to orders canceled after confirmation.”

Terms and Conditions on an Invoice

Placing the terms and conditions directly on your vendor and supplier invoice ensures that your clients are aware of them. Here’s how to add them:

- Footer Section: Add a concise version of your terms and conditions in the footer of the invoice.

- Attachment: Include a detailed terms and conditions document as an attachment or link.

- Highlight Important Points: Use bold or italicized text for critical points like due dates or penalties.

Using AP Invoice Automation Software for Streamlining Terms and Conditions

Adding AP (Accounts Payable) automation software to your invoicing process can change the way you manage terms and conditions. These tools automate the creation, tracking, and enforcement of invoice terms so you can ensure compliance and reduce manual errors. With AP automation you can standardize payment terms, calculate late fees automatically, and add custom clauses for client or project-specific needs.

Also, these tools provide real-time tracking of payments, reminders for overdue invoices, and seamless integration with accounting systems. After using AP invoice automation software you can save time, improve accuracy, and have professional and consistent terms and conditions on every invoice. This will improve cash flow and strengthen client relationships by being transparent and efficient.

Conclusion

Invoice terms and conditions are indispensable for protecting your business, ensuring smooth transactions, and maintaining a professional image. Including clear payment terms, refund

policies, and other essential clauses, ensure minimizing disputes and improve cash flow. Use the examples and templates provided above to create comprehensive terms tailored to your business needs.

If you’re looking for a professional invoicing solution, consider using software that allows you to customize terms and conditions effortlessly.

FAQs

1. Why are invoice terms and conditions important?

Invoice terms and conditions ensure clarity, protect businesses legally, and encourage timely payments.

2. What should be included in invoice terms and conditions?

Key elements include payment terms, late fees, refund policies, delivery details, tax information, dispute resolution, and confidentiality clauses.

3. Can I customize my invoice terms and conditions?

Yes, you can tailor your terms and conditions to suit your business model and industry requirements.

4. Where should I include terms and conditions on an invoice?

Add them in the footer section or as an attachment to the invoice.