Running a business means handling lots of documents, and invoices, bills, and receipts are some of the most important ones. But let’s be honest—these terms often get mixed up. You might wonder, “Is an invoice the same as a bill? How’s a receipt diffaerent?”

If you’ve ever been confused about what these documents are for, you’re in the right place. This guide will break down the differences between invoices, bills, and receipts, show you how they’re used, and share tips for managing them efficiently.

What is an Invoice?

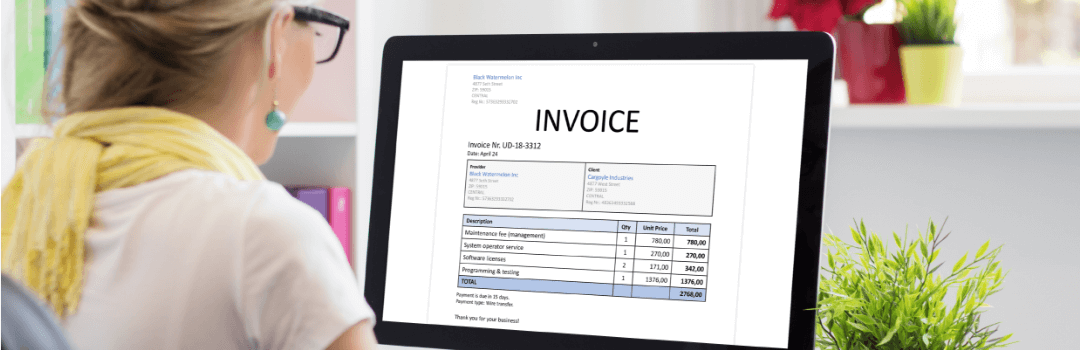

An invoice is a formal request for payment sent by a seller to a buyer. It’s used to document a transaction and provide all the details the buyer needs to make a payment.

What Does an Invoice Include?

- Invoice Number: A unique identifier for easy tracking.

- Seller and Buyer Details: Names, addresses, and contact info.

- Description of Goods/Services: What’s being billed for, including quantities and prices.

- Total Amount Due: How much the buyer owes.

- Payment Terms: Deadlines, payment methods, or late fees.

Example:

A freelance graphic designer completes a project for a client. They send an invoice for $1,500 with a 30-day payment term, detailing the services provided and how to pay.

What is a Bill?

A bill is similar to an invoice but usually refers to an immediate payment request. Bills are common in settings like restaurants or retail, where customers pay on the spot.

What Does a Bill Include?

- Items or Services: A list of what’s being purchased.

- Total Amount Owed: The final amount the customer must pay.

- Payment Due Immediately: No extended payment terms.

Example:

At a restaurant, you finish your meal, and the server hands you a bill for $50. You’re expected to pay before leaving.

What is a Receipt?

A receipt is proof that a payment has been made. It’s issued after a transaction is completed to confirm that the payment was received.

What Does a Receipt Include?

- Receipt Number: A unique identifier for tracking.

- Payment Details: Amount paid and method of payment (cash, card, etc.).

- Date of Transaction: When the payment was made.

- Details of Purchase: Items or services paid for, including quantities and prices.

Example:

After paying the $50 bill at the restaurant, you receive a receipt showing what you ordered, the total paid, and the payment method.

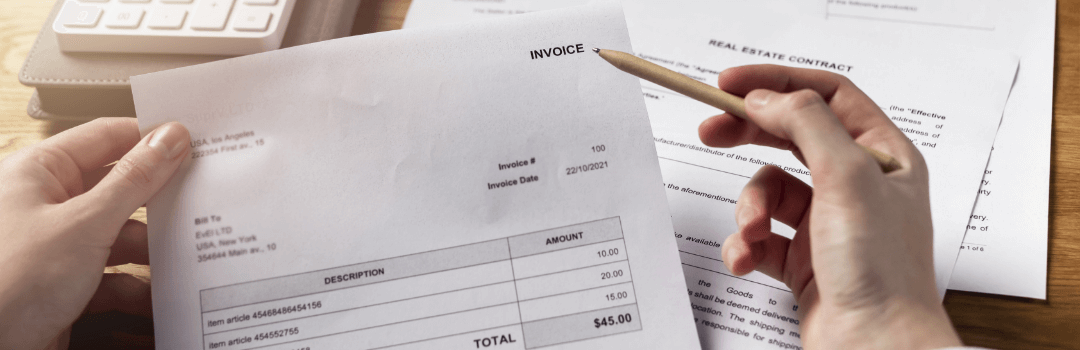

Invoice vs. Bill vs. Receipt: Key Differences

Here’s a clear comparison to help you understand how these three documents differ:

| Feature | Invoice | Bill | Receipt |

| Purpose | A document requesting payment for goods or services provided | A document requiring immediate payment for goods or services | Proof of payment issued after a transaction |

| Timing | Sent before payment is made | Given at the time of purchase or service | Issued after payment is completed |

| Payment Terms | Often includes terms like “due in 30 days” | Payment is expected immediately | No payment terms, as payment is already received |

| Includes | Itemized list of products/services, total amount due, due date, payment methods | Similar to an invoice but often less detailed; focuses on the total amount owed | Details of what was purchased, total paid, payment method, and date of transaction |

| Use Case Examples | A freelancer billing a client for project work with a 15-day payment term | A restaurant providing a bill to customers for their meal | A store providing proof of purchase after payment for groceries or products |

| Who Issues It? | Businesses selling products or services (e.g., vendors, service providers) | Businesses where payment is immediate (e.g., restaurants, retail shops) | Businesses or sellers after receiving payment |

Tips for Managing Invoices, Bills, and Receipts Efficiently

Dealing with invoices, bills, and receipts daily can get overwhelming. Here’s how to keep things organized:

- Use Digital Tools

Switch to digital systems for creating, storing, and tracking these documents. This makes retrieval easy and ensures you always have backups.

Pro Tip: Use a tool like Serina.ai to automate invoice creation, send reminders, and track payments.

- Stay Organized

Set up folders or categories for invoices, bills, and receipts. Organize them by type, client, or date to simplify record-keeping and audits.

- Reconcile Regularly

Reconciliation isn’t just for accountants. Regularly compare your invoices, bills, and receipts with your bank statements to ensure your financial records are accurate.

- Use Unique Identifiers

Assign unique numbers to every invoice, bill, and receipt. This makes it easier to find specific transactions quickly.

- Automate Where Possible

Save time and reduce errors by automating repetitive tasks. Serina.ai helps you handle invoices and receipts with ease, so nothing falls through the cracks.

Conclusion

Invoices, bills, and receipts may seem similar, but each plays a distinct role in managing your business finances. Invoices request payment, bills demand immediate payment, and receipts confirm payment was made.

Understanding these differences can help you avoid confusion, keep your financial records clean, and manage payments more effectively.

Ready to simplify how you handle invoices, bills, and receipts? Start with Serina.ai and take control of your financial workflow.

FAQs

- Is an invoice the same as a bill?

Not quite! An invoice requests payment, usually with flexible terms (like “due in 30 days”), while a bill requires immediate payment—think restaurant or retail bills.

- What’s the difference between an invoice and a receipt?

An invoice asks for payment, while a receipt confirms payment was received. They serve opposite purposes.

- Can a transaction involve all three?

Yes! A business might issue an invoice to request payment, provide a bill at the time of payment, and give a receipt after payment is completed.

- How do I keep these documents organized?

Use digital tools to manage and store them. Automation platforms like Serina.ai can handle tracking and organizing for you.

- Why is reconciliation important?

Reconciliation helps ensure your invoices, bills, and receipts match your financial records, avoiding costly errors.

- How can I automate invoice and receipt management?

Automation tools can generate, send, and store these documents automatically, reducing manual work. Serina.ai is a great option for this.

- Should I keep digital copies of receipts?

Definitely! Digital receipts are easier to search, store, and retrieve, especially for audits or disputes.

- What’s a receipt number?

A receipt number is a unique ID that makes it easy to track and verify payment records.