Reconciling invoices can be tedious, but it’s a necessary step to keep your financial workflow running smoothly. Whether it’s catching errors, avoiding overpayments, or ensuring your records stay accurate, reconciliation is crucial for businesses of all sizes.

This guide breaks down the key steps for reconciling invoices, highlights common challenges and solutions, and shows how automation can make the process faster and error-free.

What is Invoice Reconciliation?

Invoice reconciliation is the process of comparing invoices with related documents—like purchase orders, receipts, or payment records—to ensure everything matches. It helps verify that you’re paying only for what you ordered and received, and at the agreed-upon price.

For example, if a supplier sends you an invoice for 50 units at $50 each, reconciliation confirms:

- The order was for 50 units at $50 each.

- All 50 units were delivered and in good condition.

- The payment amount matches the invoice.

Done consistently, invoice reconciliation protects your business from overpayments, missed payments, and errors in financial records.

Why is Invoice Reconciliation Important?

Skipping or mishandling reconciliation can lead to:

- Overpayments: You could end up paying for things you didn’t receive.

- Missed Payments: Vendors might lose trust if payments are incorrect or late.

- Fraud Risks: Errors or fraudulent invoices might sneak through.

- Accounting Problems: Messy records can cause issues during audits or tax filing.

By reconciling invoices regularly, you ensure clean records, improved cash flow, and strong vendor relationships.

Common Challenges and How to Solve Them

Even with a solid process in place, reconciliation has its challenges. Here’s a look at common issues and how to tackle them:

1. Missing or Incomplete Information

Invoices often arrive without key details like purchase order numbers or item descriptions.

How to Solve It:

Set clear invoicing guidelines for vendors so they know what information to include on every invoice.

2. High Volume of Invoices

When you’re handling hundreds or thousands of invoices, manual reconciliation can become overwhelming.

How to Solve It:

Batch processing or automation can help you handle high volumes more efficiently, cutting down on manual effort.

3.Discrepancies in Records

It’s not uncommon to find price mismatches, missing items, or incorrect quantities.

How to Solve It:

Create a clear process for flagging and resolving discrepancies. Address these issues with your vendors or internal teams as soon as possible.

4. Lack of Coordination Across Teams

If multiple departments are involved, workflows can get messy, leading to delays and errors.

How to Solve It:

Centralize your reconciliation process so all teams can access the same data in real-time.

5. Delayed Approvals

Invoices that get stuck in approval queues can lead to late payments and strained vendor relationships.

How to Solve It:

Establish clear approval workflows with defined timelines to ensure invoices move through the process efficiently.

Steps to Reconcile Invoices

To make reconciliation smoother, follow these key steps:

- Match Invoices to Purchase Orders: Compare quantities, descriptions, and prices with your purchase orders.

- Verify Deliveries: Confirm that goods or services were received as described.

- Cross-check invoice Details: Ensure the invoice matches payment records in your financial system.

- Resolve Issues: Address discrepancies before approving the invoice.

- Approve and Document: Finalize the invoice for payment and maintain a clear record of the reconciliation process.

Automate the Process

Manual reconciliation takes time and leaves room for human error. That’s where automation can make a big difference. Tools like Serina.ai can handle repetitive tasks and streamline workflows, saving you time and effort.

What Can Be Automated?

Here’s how automation simplifies invoice reconciliation:

- Matching Invoices: Automatically match invoices with purchase orders and receipts to ensure accuracy.

- Flagging Discrepancies: Quickly identify issues, like mismatched prices or missing items, and alert the right team for resolution.

- Approval Workflows: Route invoices to the correct approvers with automated reminders to prevent delays.

- Tracking Progress: Get real-time updates on where each invoice is in the process.

- Audit Trails: Maintain an automated log of every action for easy reference during audits.

Automation helps your team focus on high-priority tasks while ensuring consistency and accuracy.

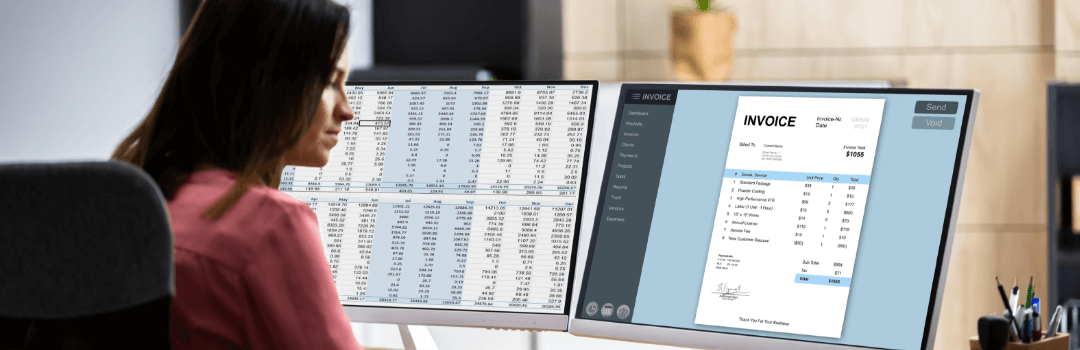

The Tool You Need: Serina.ai

When it comes to automating invoice reconciliation, Serina.ai stands out as the ideal solution.

Why Serina.ai?

Here’s how Serina.ai simplifies invoice reconciliation for businesses:

- Smart Matching: Matches invoices to purchase orders and receipts with minimal manual effort.

- Custom Workflows: Adjust workflows to fit your business processes.

- Real-Time Dashboards: Track invoice statuses and resolve bottlenecks easily.

- Error Detection: Instantly flags issues like duplicate invoices or mismatches.

- Scalable Solution: Perfect for businesses of any size, from small teams to global operations.

Learn how Serina.ai can transform your invoice process: Explore Features.

Conclusion

Reconciling invoices doesn’t have to be a headache. By addressing common challenges, following a clear process, and automating repetitive tasks, you can save time, reduce errors, and keep your financial records accurate.

Ready to simplify your reconciliation? Get started with Serina.ai and take the hassle out of managing invoices.

FAQs

1. How often should invoices be reconciled?

It depends on your business. High-volume businesses should reconcile weekly, while smaller ones might find monthly checks sufficient.

2. What’s the most common mistake in reconciliation?

The biggest mistake is skipping the step of addressing discrepancies before approving payment.

3. How can automation help with reconciliation?

Automation tools like Serina.ai handle matching, flagging errors, and managing approvals, making the process faster and more accurate. 4.

4. How do I deal with missing information on invoices?

Work with vendors to establish clear invoicing guidelines to ensure all necessary details are included.

5. What’s the best way to handle large volumes of invoices?

Use automation to batch process invoices, flag errors, and streamline approval workflows.

6. Can automation prevent duplicate payments?

Yes, automation tools flag duplicates and ensure each invoice is processed only once.

7. How can I improve coordination between teams during reconciliation?

Centralize your process using a shared platform to ensure all teams have access to the same real-time data.

8. What makes Serina.ai a good choice for reconciliation?

Serina.ai automates the entire process, from matching to approvals, reducing manual work and ensuring accuracy.